In Guide

Rent Receipts 101: What Every Landlord and Tenant Should Know

Mi Property Portal

December 24, 2023 - 7 min read

What are Rent Receipts?

Rent Receipt is a document provided by landlords or property managers to tenants as proof of payment for rent or other expenses related to their tenancy. It serves as an official transaction record and helps ensure transparency and accountability, and is also required for tax returns.

A Rent Receipt is also called:

- Rent Receipt Form

- Rent Invoice

- Rent Payment Receipt

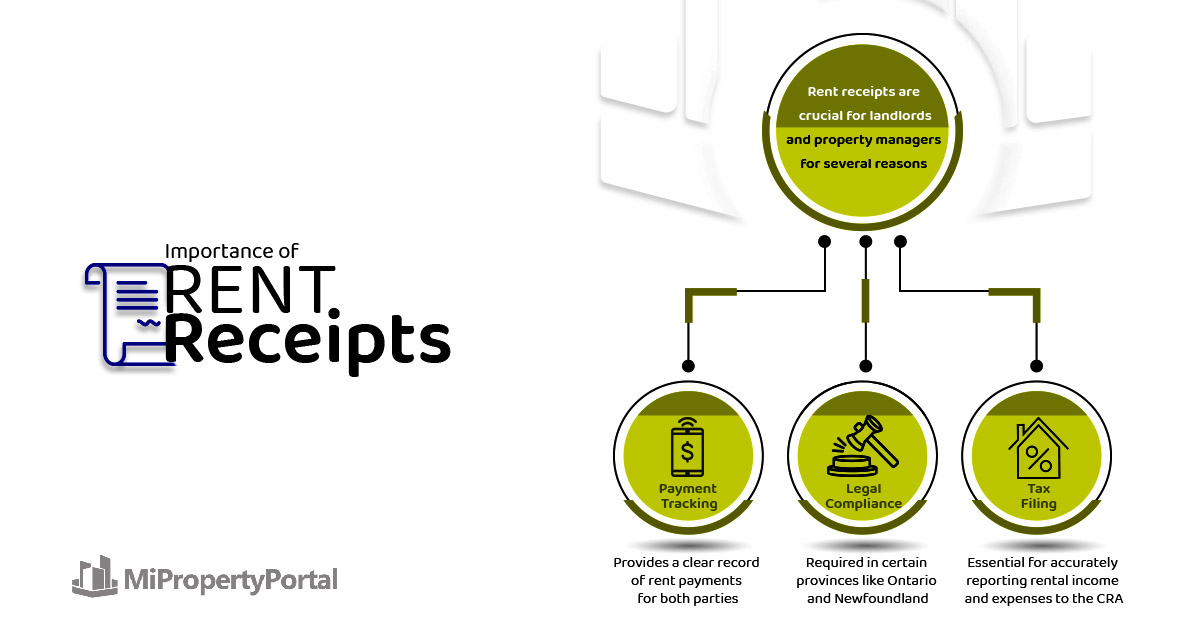

Why are Rent Receipts Important for Landlords or Property Managers in Canada?

Rent receipts are important for landlords or property managers for 3 main reasons, which are as follows:

Payment Tracking

The rent receipts eliminate any potential disputes or misunderstandings regarding the payment history. The property manager and the tenant can track rent payments in a clear and organized way.

Legal Compliance

In several provinces, such as Ontario and Newfoundland, landlords are legally required to provide rent receipts upon request. Particular regions provide benefits based on the amount of rent you have paid. In British Columbia, the landlord is required to provide a receipt if a renter pays in cash.

Three provinces—Ontario, Manitoba, and Quebec—offer tax benefits or credits that you can use to deduct your rent. Thus it is recommended to provide tenant reciepts, with signatures for claiming rent for tax returns. Moreover, signature reduces the risk of fraudulent activities. RTA Ontario does tell to include signature.

Tax Filing

Landlords should provide rent receipts for tax filing to the Canadian Revenue Agency (CRA). These documents help in accurately reporting rental income, deductions, and expenses, ensuring a hassle-free tax season.

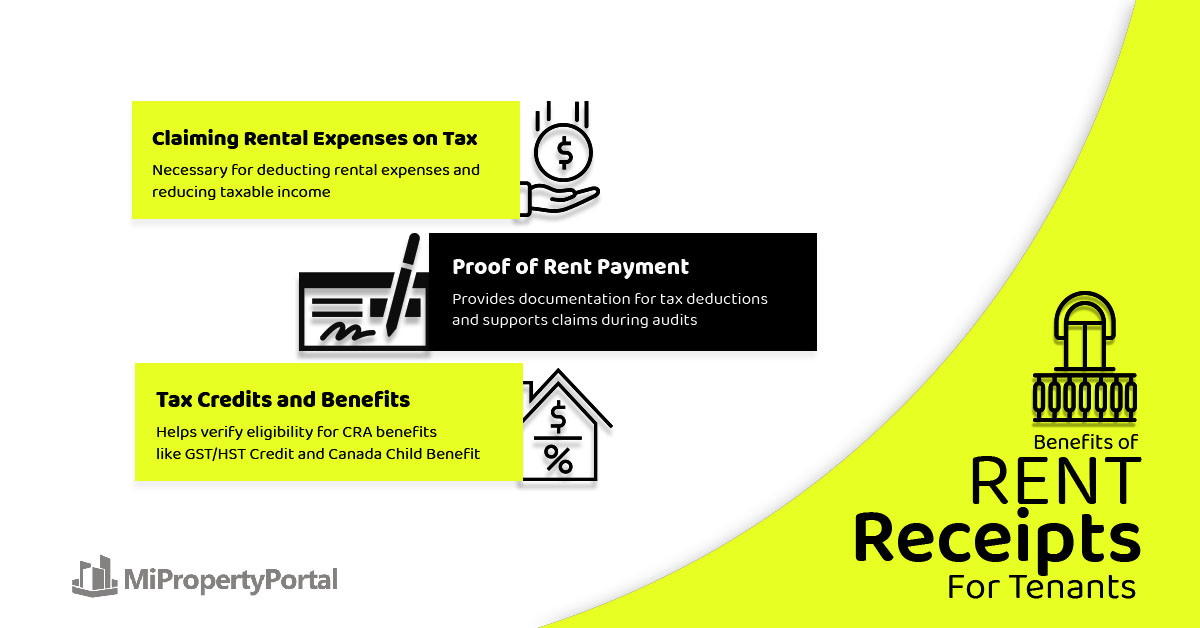

Why Should Tenants Ask for Rent Receipts?

Tenants should ask for the rent receipts for the following reasons:

Claiming Rental Expenses on Tax

Tenants have to file their last year’s income tax returns to the Canadian Revenue Agency (CRA) during the tax season at the beginning of each year. Tenants can claim rental expenses as deductions to reduce their taxable income. These expenses may include rent, property taxes, and utilities in the rental agreement. Rent receipts are essential for accurately reporting these expenses.

Proof of Rent Payment

Tenants should provide documentation of the rent payments when they claim rental expenses as tax deductions. Rent receipts serve as proof of rent payments and support these deductions during a tax audit or review by the CRA.

Tax Credits and Benefits

The CRA offers certain tax credits and benefits for eligible tenants. For example, the CRA administers the GST/HST Credit and the Canada Child Benefit, which consider a taxpayer’s living situation, including rent payments. Rent receipts help verify eligibility and ensure accurate benefit calculations.

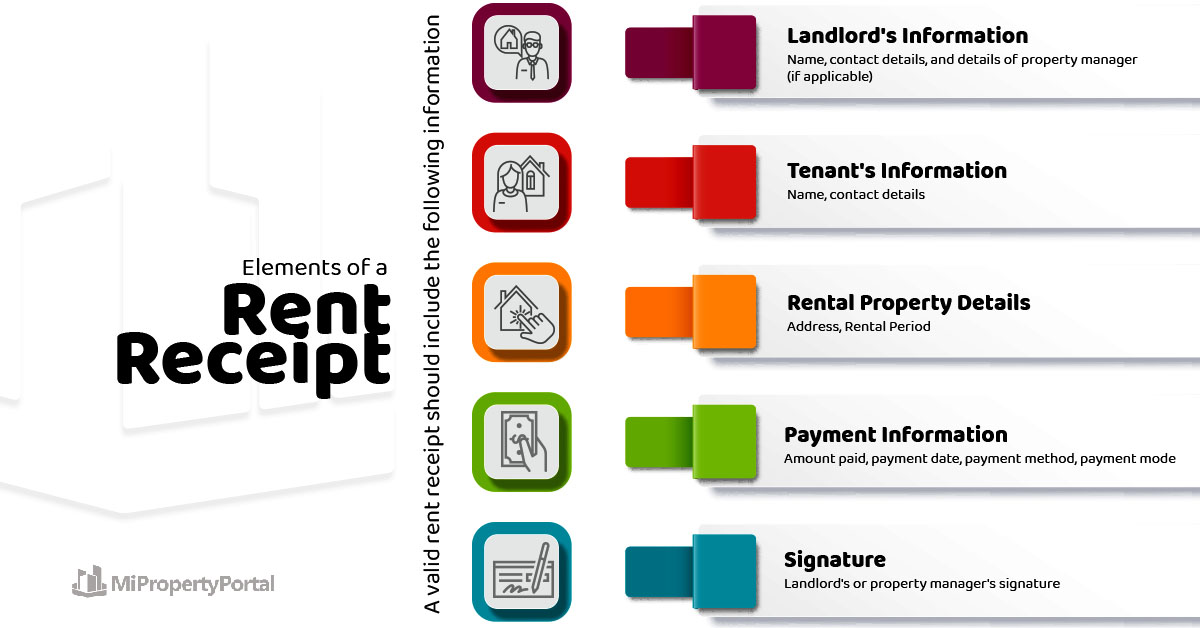

What Information Should be Present on a Rent Receipt?

A valid rent receipt should include the following information:

- Landlord’s Name and Contact Information – The Full Name, Phone, Email

- Name and Details of Property Manager (If Applicable)

- Tenant’s Name

- Rental Property Address – Street, City, Province/Territory, Postal Code

- Beginning Date and End Date of Tenancy

- Amount Paid

- Payment Date

- Remaining Balance

- Date of Receipt Created

- Payment Method

How was the rent paid?

- By cash

- By check

- Money Order

- Electronic Fund Transfer (EFT)

- Other payment method.

- Including the payment method helps maintain a transparent financial record.

Payment Mode

How the rent is paid?

- Weekly

- Semi-Monthly

- Monthly

- Half Yearly

- Yearly

Signature

The Signature of the Landlord or the Landlord’s Authorized Agent/Property Manager. It is legally required if you are submitting your rent reciepts for tax returns purpose.

Template of Rent Receipt

Here’s a sample format for a Rent Receipt

RENTAL RECEIPT

Receipt Date: Month Date Year

Rental Property Information

Address: Number, Street, Province, State, Canada

Landlord’s Name and Contact Information:

Name: Full Name

Phone: XXX

Email: XXXX

Name and Details of Property Manager (If Applicable):

Rental Period

From: To:

Tenant Information

Name: Full Name

Phone: XXX

Email: XXXX

Amount Paid: Remaining Balance:

Payment Date :

Payment Method :

- By cash

- By check

- Money Order

- Bank Transfer

- Electronic Fund Transfer (EFT)

Payment Mode :

- Weekly

- Semi-Monthly

- Monthly

- Half Yearly

- Yearly

This receipt acknowledges that (Landlord’s Name) has been paid the (Paid Amount) for the Rental Period of ________ to _______.

_____________ _______________

Name Signature

Click here to download a docx file and edit it according to your needs.

In MiPropertyPortal (MIPP) rent receipt generation is just as simple as clicking a button. It is an all-in-one property management software for Canadian landlords and property managers. With MIPP, rent receipts are automatically generated after each rent payment is received.

With a click, the rent reciept can be downloaded or the receipt can also be emailed directly from the software. Also, if the tenant asks for a Yearly Rent Receipt, you can download that too or email it like the monthly rent receipts.

The tenant can also go to your Payment History in the Tenant Portal and download the any payment receipts or yearly rent receipt without knocking the landlord or the property manager.

MiPropertyPortal also can fully automate tenant rent collection <put the link to rent automation page> and generate financial Reports, etc. Click here to get a demo.

Bonus Tips for Tenants: Claim Rent on Tax Return for Self-Employed and Work From Home

Self-Employed Tenant

Self-employed renter can deduct a portion of their rent from their taxes if they use a portion of the rented property for business purposes.

How much rent they are eligible to claim is determined by the space they occupy for business purposes. For instance, they can only deduct 20% of their rent if their office takes up 20% of the rental’s total square footage.

Self-employed tenants can use Form T2125 – Statement of Business or Professional Activities to deduct their permitted rent.

Tenant Who Works From Home

A tenant can also claim a tax deduction on their tax return for a portion of their rent if they work from home. They should meet specific requirements to deduct rent.

These requirements are listed on Form T2200 – Declaration of Conditions of Employment. You can download the Form T2200 by clicking here.

The employer should fill out this form and give it to them to verify that the tenant is qualified for the rent deduction.

Conclusion

A rent receipt letter serves various purposes, including legal compliance and tax filing. It is an important document for both tenants and landlords. Both parties can ensure a smooth and transparent rental experience by maintaining a clear and organized record of rent payments. If you have any further questions or need assistance in creating a rent receipt, feel free to contact us.

Frequently Asked Questions (FAQs)

Landlords are legally required in certain provinces suc has Ontario and Newfoundland to provide rent receipts upon request. It is recommended to give one and to check the specific regulations in your province.

Yes, rent receipts (manual or digital) are required for tax purposes, provided they contain all the necessary information.

It is recommended that both landlords and tenants have a record of every payment, including cash, to avoid future disputes.

In some cases, tenants may be eligible for rent-related tax deductions, mainly in Ontario, Manitoba and Quebec. You can consult a tax professional for guidance.

No. Landlords should give the Rent Receipt for rent payment free of charge and on request.

Yes, tenants can request rent receipts for past payments. Landlords should be able to provide these upon request.

In most provinces such as Ontario and Newfoundland, landlords must provide rent receipts upon tenant request. However, it's a good practice for tenants to request receipts regularly for their records.

It is a good idea to provide a copy of your official rent receipt documents, even if you get paid your rent electronically, as Revenue Canada may need them to validate any rental income you claim.